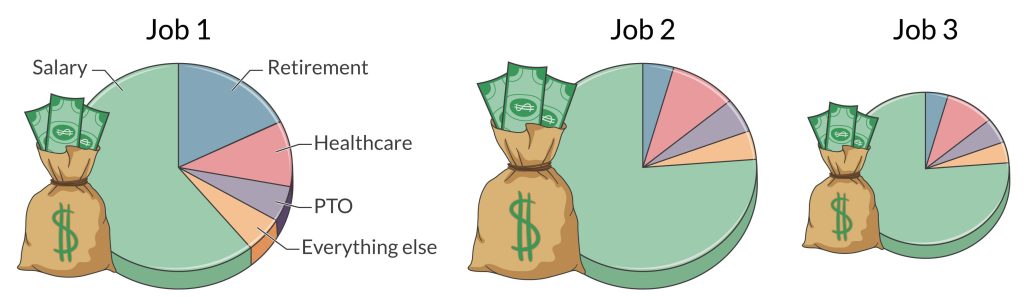

There’s more to landing the right CRNA position than chasing the highest salary. Even if you prioritize pay above lifestyle, location, or scope of practice, focusing on base salary alone can lead you down the wrong path. Instead, think about total compensation, where you can view it as a pie with salary being only a part of the whole.

When you understand how each factor affects your total compensation, you can confidently negotiate and avoid costly mistakes. This article breaks down every major component of a CRNA salary, translates industry jargon into plain numbers, and gives you the tactical guidance you need to compare job offers, apples to apples.

DISCLAIMER: This information is for educational purposes only and is not financial, tax, or legal advice. We’re not CPAs, financial advisors, or attorneys. You should consult with a qualified professional before making any financial, tax, or business decisions. Additionally, we’ll speak in generalities throughout this article, so recognize that there are always exceptions.

Table of Contents

- Base Salary

- W-2 vs. 1099

- Retirement Plans

- Health Insurance

- Disability Insurance

- Malpractice Insurance

- Paid Time Off

- Sign-on Bonus

- Retention Bonus

- Professional Development Benefits

Base Salary

An employer doesn’t set a CRNA’s salary arbitrarily. Instead, it’s a reflection of underlying market dynamics.

Geographic Factors: The most significant driver is the CRNA supply-and-demand balance in a given region. Rural areas or regions with fewer anesthesia providers may need to offer more attractive compensation packages to attract top talent. Conversely, desirable markets (often urban or tourism destinations) typically offer a comparatively lower base compensation (all other things being equal) because employers face less difficulty filling positions.

Beyond Geographic Factors: Compensation reflects the practice setting, payer mix, and job requirements. Positions involving higher clinical complexity (e.g., cardiac, trauma, and OB) or extensive call requirements generally pay more due to the specialized skill sets required and the added burden of unpredictable schedules.

Staff turnover rate may impact the need to offer higher pay to attract talent. For context, the few studies that examine CRNAs suggest 9–12% average annual turnover. Payer mix (the ratio of private health insurance, Medicare, Medicaid, and self-pay) impacts a facility’s bottom line and can influence CRNA salaries, where a higher balance of private health insurance and self-pay often increases revenue. Finally, critical access hospitals get higher reimbursement rates because they receive reasonable costs instead of the fixed rate set by Medicare’s payment system, which explains why they typically pay well.

Practice Model: How you’re deployed in the OR directly shapes your paycheck (our example assumes all other things are equal).

- Physician‑led ACT model (1 MD: < 4 CRNAs): One anesthesiologist may supervise multiple CRNAs, so the revenue is split across providers.

- Mixed model (1 MD: > 4 CRNAs): CRNAs run solo rooms, but an MD is available for consultation. Salaries are likely to increase because the pie is split between fewer providers.

- CRNA‑only or independent practice: Every anesthesia dollar flows through the CRNA team. You’re also carrying the full clinical responsibility (e.g., blocks, lines, call, and decision‑making), which justifies a premium for the added autonomy and liability.

🔍 APEX Insights

- Always translate an offer into total compensation (base pay, bonuses, benefits, and call differentials), not just the headline salary. Remember this when you use the salary filter when using a job board. Check out the APEX CRNA Job Board to find top jobs in your location.

- Balance money against lifestyle. High pay often comes with strings attached, such as heavy call, remote geography, high‑acuity cases, or a toxic work environment. Make sure the trade‑off works for you and your family.

- If a position offers notably higher compensation compared with similar jobs, carefully assess organizational stability, provider turnover rates, and regional healthcare market conditions to ensure you’re making a sustainable career decision.

- Regularly revisit industry CRNA salary benchmarks (e.g., AANA salary surveys) to strategically negotiate higher compensation in line with your skills and the complexity of your role.

- Critical access hospitals can out‑pay urban centers because of cost‑based Medicare reimbursement (i.e., Medicare reimburses higher for these facilities to help keep them in business). Verify that status before you sign.

W-2 vs. 1099 Independent Contractor

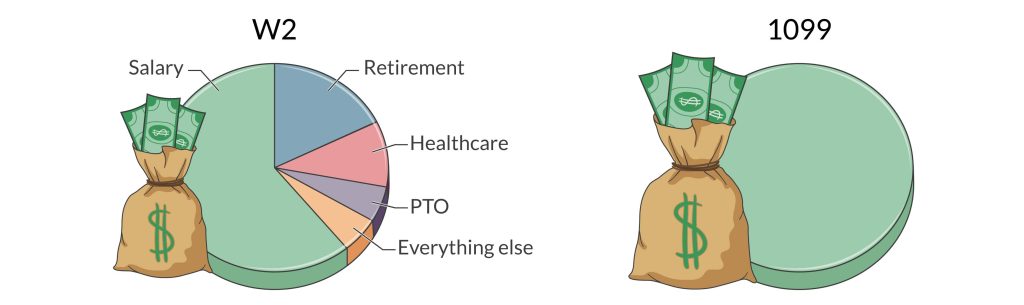

Choosing between a W-2 employee and a 1099 independent contractor role significantly impacts your financial planning, benefits structure, and career flexibility. One is not inherently better than the other (despite what you see on social media), so take the time to determine what’s best for you. We dive deep into 1099 here but, for now, you should understand both in terms of your total compensation package.

W-2: As a W-2 CRNA, your employer handles employment taxes (e.g., social security and Medicare taxes) and provides comprehensive benefits such as health insurance, retirement plans, malpractice insurance, PTO, CE funds, and other benefits, thus simplifying your financial management. Because your employer picks up the tab for these things, your salary will represent a lower percentage of your total compensation.

1099 Independent Contractor: Conversely, 1099 positions offer higher base compensation rates but shift responsibility for taxes, benefits, and retirement planning entirely onto you. This increases your financial responsibility and administrative workload.

Key responsibilities of 1099 CRNAs include setting up and maintaining your business entity, paying quarterly taxes, maintaining a separate business bank account for your business expenses (never mix business and personal expenses), obtaining health insurance on the private market, and setting up your retirement plan (e.g., solo 401(k) or SEP IRA). You may also benefit from tax deductions related to your business, and you might qualify for the qualified business income (QBI) deduction if you meet certain thresholds. Many CRNAs elect to work with a CPA, financial planner, and/or attorney to ensure they’re doing things correctly, which adds to your expenses as a 1099.

🔍 APEX Insights

- Evaluate each employment type by calculating your effective net income after taxes, retirement contributions, healthcare premiums, malpractice insurance, and other benefits we discuss.

- Consider your risk tolerance, financial discipline, and administrative capacity when evaluating 1099 roles, as they require meticulous financial planning and management.

- Consult a CPA and/or financial planner experienced in CRNA compensation to accurately estimate your total financial responsibility and potential tax deductions in a 1099 role.

Retirement Plans: 401(k), 403(b), Pension, Profit Sharing

Employer Matching Contributions: Many employers offer to match a percentage of your salary that you contribute to your 401(k). For example, if your employer offers a 100% match on up to 5% of your salary, and you contribute 5%, your employer will add an additional 5%, effectively doubling your contribution. Think of this as free money. Also, some companies require you to opt in to their retirement plan, while others enroll you by default and allow you to opt out.

Profit Sharing: Some organizations (typically private practices) may distribute some of the company’s profits. This follows a predefined formula set by the company’s plan.

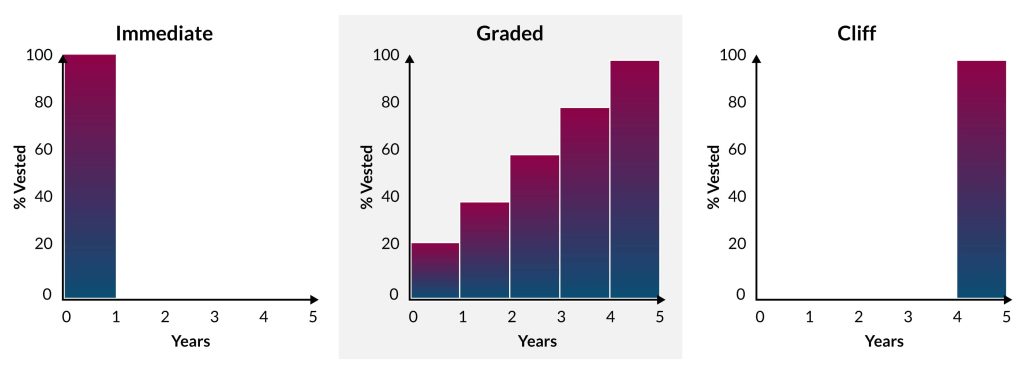

Vesting Schedule: Vesting refers to the period of time you must remain employed before you fully own your employer’s contributions to your retirement plan. Leaving before you are fully vested means you forfeit a portion (or all) of the employer’s contributions.

- Immediate vesting schedule = You own the funds as you receive them.

- Graded vesting schedule = You gain ownership gradually over time (e.g., 20% per year over 5 years).

- Cliff vesting schedule = You must stay a set number of years before you own any of the employer’s contributions (e.g., 100% vested after 5 years).

Pension: A pension is a retirement plan in which an employer contributes funds on behalf of an employee, often based on salary and years of service, with the promise of providing a fixed, regular income after retirement. Unlike 401(k) plans, which depend on individual contributions and investment performance, pensions typically offer guaranteed lifetime payments, making them highly valuable but increasingly rare.

🔍 APEX Insights

- A strong employer match can be worth thousands of dollars annually, which compounds over the duration of your career.

- Job hopping (e.g., consistently leaving positions before reaching full vesting) can cost you tens of thousands of dollars (or more) by significantly reducing your long-term retirement savings.

Health Insurance

Health insurance is the sleeper variable that can swing your real take‑home pay by thousands, yet many CRNAs skim past it. A W‑2 offer might offer a lower salary but cover 75% of family premiums, throw in dental and vision, and seed an HSA each January. Before considering a 1099 role, price out the cost of obtaining your own health insurance. Many 1099s choose the least-expensive, high-deductible plans to keep monthly premiums manageable. Make sure you understand the risks of the coverage level you choose.

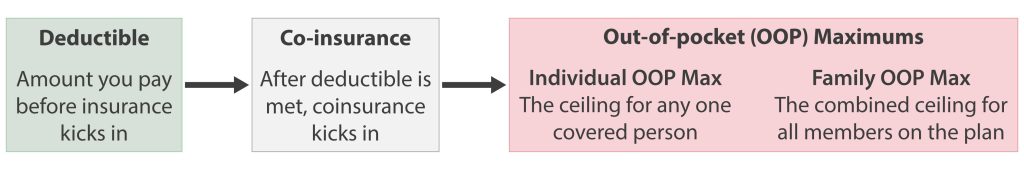

Dig deeper than the brochure when evaluating an employer’s health insurance options. Ask for the full Summary of Benefits and Coverage and run the math on annual premium share plus worst‑case out‑of‑pocket costs. Let’s take a minute to consider these things.

- Annual premium: This is what you pay for your health insurance policy. If you’re a W-2, your employer may pay for all or part of your (and your family’s) premium.

- Deductible: This is the amount you will pay before insurance kicks in. This amount resets to zero each year.

- Co-insurance: After you meet your deductible, co-insurance kicks in. Your policy will pay a certain percentage of in-network costs until you hit your out-of-pocket maximum.

- Out-of-pocket (OOP) maximums:

- Individual OOP max = The ceiling for any one covered person.

- Family OOP max = The combined ceiling for all members on the plan.

- Employer-funded HSA contribution: If you have an HSA, an employer may deposit money into your account as a benefit of employment.

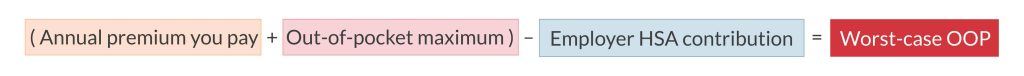

Here’s how to calculate your worst-case OOP. This example uses an HSA with an employer contribution; however, if you didn’t have this benefit, then you’d remove it from the equation.

How a family OOP maximum works

Plan design

- Individual OOP max = $7,500

- Family OOP max = $15,000

Family expenses

- Early in the year, your spouse needs surgery and quickly hits the $7,500 individual cap. From that moment on, the plan pays 100% of your spouse’s covered, in‑network costs for the rest of the year.

- Mid‑year, your child breaks a leg. After deductibles and co-insurance, the child’s bills add another $5,000 to the family total.

- Later, you have an unexpected ER visit that costs $2,500 out of pocket.

Running total

- Spouse = $7,500

- Child = $5,000

- You = $2,500

- Family OOP spend: $15,000

Because the combined expenses now equal the $15,000 family cap, the plan begins paying 100% of covered, in‑network costs for everyone in your household for the remainder of the year. If only one family member had expenses, your exposure would have stopped at $7,500 (at the individual OOP max), but with multiple members needing care, you had to be prepared for the higher $15,000 worst‑case spend.

Know what counts towards your out-of-pocket maximum. Most in‑network deductibles, co-insurance, and copays apply, but out‑of‑network charges often do not. If you live near only one hospital, make sure it’s in‑network. Otherwise, the “max” isn’t really a ceiling.

Finally, look at soft benefits, such as employer‑funded HSAs, mental health coverage, fertility services, or tiered pharmacy programs. Those can save (or cost) thousands over the life of a contract.

🔍 APEX Insights

- Price the “all‑in” number, not just the premium. Add your annual payroll deduction to the plan’s out‑of‑pocket maximum; that total is the true worst‑case cost you must be ready to cover.

- If you’re selecting a plan as a 1099, match the network to your life, not your ZIP code. Confirm that the plan’s in‑network hospitals include the regional trauma center, children’s hospital, and any specialists you’d actually use. If the right facility is out-of-network, saving a few dollars on premiums is pointless.

Disability Insurance (Short- and Long-Term)

Disability insurance provides income protection if you’re unable to work due to illness or injury.

Short-Term Disability (STD): Short-term disability is designed for common, high-probability events such as surgery, injury, or pregnancy complications. STD typically lasts from a few weeks to 6 months, with a short waiting period (often just a few days) before benefits begin. Short-term disability policies often replace 50–70% of your salary, helping cover expenses while you recover. STD policies are more expensive because they pay almost immediately after a claim is filed, which increases the insurer’s financial risk.

Long-Term Disability (LTD): Long-term disability is intended for serious or long-term medical conditions that prevent you from working for an extended period (often years or even until retirement). LTD benefits typically begin after a waiting period of 90–180 days and replace 50–60% of income. While many employers provide short-term disability as part of their benefits package, long-term disability coverage is often optional or self-funded, making it crucial for CRNAs to consider private LTD insurance to ensure financial security if they develop a condition that prevents them from working long term.

Tax Implications of Disability Insurance: Understand the tax implications of your policy. If the premiums are paid by your employer with pre-tax dollars, these benefits are typically taxed as regular income. Conversely, if you pay the premium with after-tax dollars, then the benefit won’t be subject to tax.

“Own-Occupation” vs. “Any-Occupation”: Own-occupation disability insurance pays benefits if you can’t work as a CRNA, even if you can work in another field with your disability. This ensures better income protection, since you’re not likely to match your CRNA salary doing any other type of work. Conversely, any-occupation policies only pay if you are unable to work in any job, meaning you could be denied benefits if you can still perform a lower-paying role outside of anesthesia.

🔍 APEX Insights

- If your employer pays for your disability insurance, check whether they report premiums as taxable income. This will help you understand the net benefit if you ever need it in the future.

- If your employer lacks its own-occupation policy, consider a private supplemental plan to protect your CRNA income. Choose a reputable insurer with coverage that defines disability specific to your clinical anesthesia role.

Malpractice Insurance

There are two types of malpractice insurance, and they can have profound implications spanning your entire career.

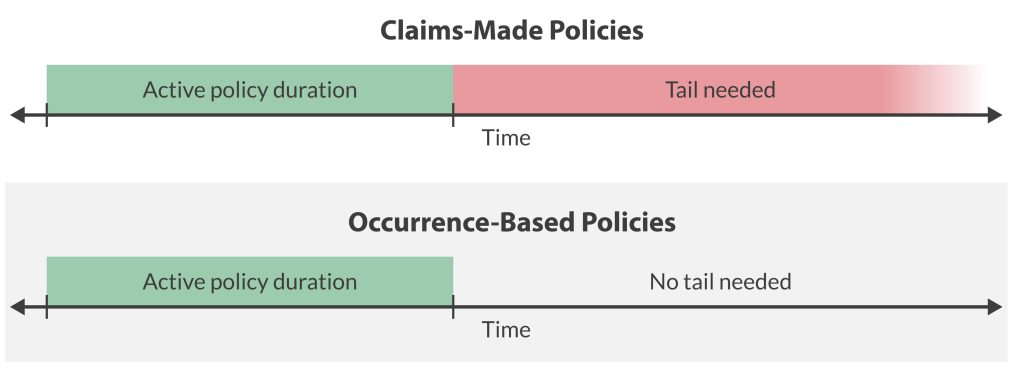

Claims-Made Policies: Only cover incidents reported while the policy is active (i.e., when working for your current employer). If you leave the job, you’ll need to purchase tail coverage to protect yourself from future claims, otherwise you risk being uninsured for previous cases. Not all employers will provide tail coverage if you leave, and those that do may require you to work for them for a specified period before offering this benefit.

Occurrence-Based Policies: Cover incidents that happened while you were employed, regardless of when a claim is filed. These policies are more expensive but eliminate the need for tail coverage.

Tail Coverage: If you have a claims-made policy, tail coverage ensures you’re protected after leaving the job for another job or retirement. Without it, you could suffer a significant financial burden if you leave your job and someone files a claim against you. One key issue is that tail coverage is expensive, costing up to three times (or more) of your current malpractice premium. Some states require you to carry tail coverage, so you should understand the laws for all states where you maintain your CRNA license.

Nose Coverage: While tail coverage protects you after you leave a job with a claims‑made policy, nose coverage (sometimes called “prior‑acts” coverage) protects you before your new policy’s start date. When you switch employers, the incoming group can add a nose endorsement that backdates your new claims‑made policy to cover any incidents that occurred under your previous employer but haven’t yet been reported. In effect, nose coverage shifts the liability gap from the old job to the new policy, eliminating the need to buy expensive tail coverage.

If the new employer provides nose coverage, you may be able to walk away from your old job without purchasing tail insurance, saving you thousands! However, many groups refuse to assume that risk, so nose coverage is less common than tail.

Coverage Limits: Your policy will list two limits of liability:

- First limit of liability: The amount the insurance company will pay for any one claim.

- Second limit of liability: The amount the insurance company will pay in total during the coverage period (typically annually).

Standard coverage options are typically $1M per claim (first limit) and $3M annually (second limit), but requirements vary by state.

While some CRNAs opt to get the minimum required by the state, others elect higher coverage. Some will argue that higher coverage limits or coverage separate from your employer that is covering you will make you appear to have “deep pockets” and, thus, a bigger target by attorneys trying to maximize their client’s benefit.

If your employer is paying for coverage, keep in mind that if a claim is filed, your employer may not have your best interests in mind. Understand if you need to consent before your claim is settled (vs. taking it to trial). Often, it’s in the employer’s best interest to settle, even if this isn’t what’s best for the CRNA.

🔍 APEX Insights

- Always ask if the employer provides tail coverage or if you’ll need to purchase it yourself. If they don’t cover it, negotiate a higher salary to offset the cost.

- Ask if tail coverage is fully paid, partially paid, or employee-funded, and get it in writing before signing a contract.

- Never assume your new policy automatically covers prior acts. Without a nose endorsement or tail coverage, you could be personally liable for past cases.

- How does the malpractice policy cover expenses incurred while defending you? Some policies pay on top of your limits, while others deduct these costs from your limits.

- The best policy is one that requires your consent before a claim is settled out of court.

Paid Time Off

Time is Money: Paid time off (PTO) is essentially part of your salary. It represents paid hours you’re not working, so it has real financial value. A job with more PTO may have a lower base salary but could be worth more overall when factoring in the paid time off.

For example, a job with a base salary of $200,000 with 8 weeks of PTO is financially equivalent to a job that pays $218,182 with only 4 weeks of PTO. In both cases, the total compensation (salary + PTO value) equals $236,364, proving that more PTO can offset a lower base salary in overall earnings.

Accrual vs. Lump-Sum: Accrual-based PTO means you’ll receive PTO throughout the year (e.g., 1.5 days per month). If you leave before the year ends, you may not get your full PTO allotment. Lump-sum PTO means you’ll get your annual PTO upfront, meaning you can use it anytime. However, some policies require repayment if you leave before a certain period.

Rollover PTO: Some employers allow unused PTO to carry over into the next year, while others limit how much can be retained.

Use-It-or-Lose-It: If unused PTO expires at the end of the year, the benefit is lost if you can’t take time off.

PTO Buyout: Some employers allow cashing out unused PTO upon termination or at the end of the year.

Holidays, Sick Leave, and Separate PTO Banks: Some employers bundle vacation, sick leave, and personal days into one PTO bank, while others keep them separate. A job with 6 weeks of PTO might be misleading if it includes sick leave and holidays.

🔍 APEX Insights

- Get clear on your values and priorities (time or money) as you evaluate job offers.

- PTO is only good if you can actually use it when you want. Ask the employer about their process of approving PTO, especially around times of high demand (e.g., holidays, spring break).

Sign-On Bonus

Contract Commitment: Nearly all sign-on bonuses require a commitment to work for the company for a specified period (typically 1–3 years). Leaving early may require full or partial repayment (this is called a clawback clause). Before accepting a sign-on bonus, get clear on what happens if your employment is terminated (either by you or your employer) if you don’t serve the full term. You should have this in writing.

Payout Timing: Bonuses may be paid upfront, in installments, or at contract completion. Delayed payouts reduce their immediate value. Also, consider how the timing of installments affects your tax bracket for the year. For instance, you’ll keep more of a $50,000 bonus when you have no or little other taxable income for the year (i.e., you’re in your senior year, and you’ll start your job next year). As always, consult your tax advisor to discuss your unique situation. If you spend the money, you’ll be locked into satisfying your commitment term if you don’t have another way to return the payment to your employer.

Market Demand: Employers offer sign-on bonuses out of need (even if they truly are great people), so you’re less likely to receive one in highly desirable locations, where the market is more likely to be saturated. Adjust your expectations accordingly.

🔍 APEX Insights

- Negotiate payout terms to receive at least 50% of the bonus upfront.

- Read the fine print to understand the clawback clause and whether the bonus is guaranteed if the company is acquired or terminates you without cause (e.g., the anesthesia group loses its contract with your hospital).

- Reduce your expectations of a signing bonus in oversaturated or highly desirable markets.

Retention Bonus

Like a sign-on bonus, understand the length of service required, as it may require you to commit for several years before you receive your bonus.

CRNA turnover average is ~9–12% annually. High turnover workplaces may use retention bonuses as a Band-Aid solution to keep providers.

🔍 APEX Insights

- A big retention bonus may signal ongoing workplace issues. If staff turnover is high, ask why and what else is being done to improve retention.

- Factor in base salary. A lower salary with a big retention bonus may not be a great deal long term.

Professional Development and Mobility Benefits

Continuing Education Funds: Most employers set an annual dollar amount (often $1,000–3,000) to cover conference fees, online courses, certifications, travel, and lodging. Clarify whether the allowance renews each calendar year, rolls over, disappears if unused, and what happens if you spend it and leave your job before the end of the year. Ask if CE days are separate from PTO. Burning vacation time to attend a conference dilutes the value of the benefit.

Student Loan Repayment: Hospitals in high‑need or rural areas frequently offer fixed annual payments or lump‑sum forgiveness in exchange for a multi‑year service commitment. Confirm the total dollar amount, the payout schedule, and any clawback clause if you leave early. For CRNAs working at non‑profit facilities, pair employer repayment with the federal Public Service Loan Forgiveness program to maximize savings.

Tuition Assistance: If you plan to pursue a DNP, MBA, or leadership certificate, tuition assistance can offset tens of thousands in future costs. Some organizations reimburse per credit hour, while others pay a percentage of tuition after you complete the course with a minimum grade. Verify whether the assistance covers only degree programs or also specialty courses like ultrasound‑guided regional workshops (this might be covered by your CE funds, instead).

Relocation Assistance: Moving packages can include professional movers, airfare, temporary housing, and lump‑sum stipends for incidentals. Get the offer in writing. Is it paid upfront or reimbursed? Most packages carry a repayment clause if you quit within a defined period of time, so weigh the benefit against your long‑term commitment.

🔍 APEX Insights

- Stack benefits. Use CE funds to attend a conference that also satisfies tuition requirements for an advanced degree. Double dipping may be allowed if expenses fall within policy limits.

- Student loan repayment and relocation assistance may be reported as taxable income unless specifically structured otherwise. Build the tax hit into your cash‑flow plan before you sign.

Final Thoughts

Total compensation is a puzzle with many interlocking pieces. Base pay, benefits, bonuses, insurance, and time off each tell part of the story. Use this guide to run the numbers, weigh the lifestyle impact, and spot red flags before you sign. When you approach every offer with a clear grasp of the market and a firm handle on your priorities, you turn the negotiation into a data‑driven conversation: one that positions you, not the employer, in the driver’s seat.

When you’re ready to take the next step in your career, the APEX Anesthesia Job Board is here to help you find the right fit.