As chronicled in Ed Yong’s remarkable book, An Immense World: How Animal Senses Reveal the Hidden Realms Around Us, creatures of all kinds observe, sense, interact with, and experience our world differently than humans do. Consider that a platypus or shark senses the electric auras cast out by potential prey or enemies alike. The tiny jumping spider has eight eyes occupying over half the volume of its head, each strategically tasked. Some hummingbirds and many insects respond to ultrasonic tones. Dogs, ants, moths, and forked-tongued snakes detect odorants at infinitesimally small titers. The mosquito tastes through receptors on its feet—landing on skin sprayed with DEET signals the insect to “get off ASAP.” Sea turtles and other critters use magnetoreception to navigate. All define how each interacts with their environment and how they become masters of it.

Yong defines how an organism senses, interacts with, perceives, and experiences their environment as their “Umwelt,” based on work by an early 20-century biologist. For example, we hear the world around us as the energy that emerges from beyond and arrives at our auditory detectors. A bat hears the world quite differently. It inputs energy into the ether, recapturing it as it bounces back. As Yong eloquently notes, “The bat speaks, and a silent world shouts back.” Our Umwelts are as different as night and day.

These incredible adaptations give each creature a unique edge in the game of survival. Whether it’s snagging a hidden meal or slipping away from a lurking predator, their specialized traits open doors to life’s essentials. They help animals find shelter, move confidently through their environment, and reproduce successfully. In short, these organisms don’t just survive in their worlds—they thrive in them. They are the undisputed masters of their own Umwelt, perfectly tuned to the rhythms of their surroundings.

Human senses are too often underestimated as only five: touch, hearing, sight, taste, and smell. But this is a considerable injustice by not including proprioception (body segment sensing), equilibrioception (sense of balance), sense of hunger, sense of thirst, and our immune sense (immune system senses an attack by foreign intruders). And what about that ‘sense that we have about something,’ that is, our gut feeling or instinct? We could add to the list, but you get the point. Now, marry these varied senses to our training and experience, and you have an extraordinary package. This positions each of us, as CRNAs, into a category of healthcare providers whose talent domain is arguably shared exclusively with physician anesthesiologists. And perhaps we should consider expanding the CRNA role into postoperative care.

Table of Contents

The CRNA’s Umwelt

You may think we are being self-serving, but to justify our view, allow us to elaborate. We expertly interact with, perceive, react to, and experience one of planet Earth’s most complicated, constantly evolving environments. Doing so describes our Umwelt: the operating room, caring for a patient having surgery under the influence of arguably the most dangerous drugs in the formulary. We navigate our Umwelt using a sophisticated array of technologies extending the capabilities of our innate senses. This is all nourished, fine-tuned, and interpreted using our unique education, training, and experience.

Our Umwelt isn’t static—it’s a living, evolving landscape. In just the past few years, we’ve witnessed a wave of innovation: new agents, cutting-edge techniques, breakthrough technologies, and transformative care pathways. Not only have these advances emerged, but they’ve also stood the test of rigorous evidence, pushing beyond established thresholds and reshaping what’s possible in our environment. As we observed during the COVID-19 pandemic, CRNAs experienced, with confidence and aplomb, a new dimension in their scope of practice where they assumed a greater perioperative presence. We observed CRNAs being used as clinical intensivists in many institutions as their Umwelt expanded. Our observations were fueled by the knowledge that while anesthesia and surgery have grown safer, the common and significant burden of mortality in the immediate postoperative period remains largely unappreciated by many and remains poorly understood.

Postoperative surgical mortality: How concerning is it?

How significant is this burden? While patients undergo surgery for targeted benefit, the risk of death, as conveyed in even routine surgical consents, is always a possibility. Of course, the risk of its occurrence varies greatly based on the nature of the surgery, patient comorbidities, and the providers’ skill and experience. If deaths occurring shortly after surgery were classified as a distinct cause, they would rank just behind heart disease, stroke, and cancer among the leading causes of death in the United States.

In a remarkable lecture, Dr. Daniel Sessler, Professor and Chair of the Department of Outcomes Research at the Cleveland Clinic, and the most highly published and extensively cited living anesthesiologist, detailed an alarming practice issue. He noted that death occurring within 30 days of surgery remains very high and has not budged much in recent decades. He terms it “anesthesia’s greatest challenge.”

Myocardial injury, major bleeding, sepsis, stroke, and human error are major causes of postop death, and while purely respiratory deaths are not frequent, those that do occur are likely preventable. Studies using continuous, real-time electronic monitoring reveal that hypotension and hypoxemia occur frequently, events that are missed given the Nightingale-ish persistence of taking vital signs only every 4-6 hours on the floor.

A prominent anesthesia safety expert, Dr. Steven Shaeffer, long-time editor of Anesthesia & Analgesia, recently echoed Sessler, citing postoperative mortality as “the major problem facing anesthesiology.” Even in institutions your APEX team has worked in, hospitalists and medical internists have expanded their role to include postoperative patient management. Did you know that fellowships are now offered in internal medicine programs in perioperative medicine? Yet if we are to believe Sessler and others—and the supporting evidence seems overwhelming—current efforts have been far less than impactful.

An Umwelt-expanding domain for the CRNA?

CRNAs’ responsibilities are generally discontinued at PACU handoff as a matter of policy, circumstance, and logistics. Yet our knowledge, experience, insightfulness, and familiarity with the interactivity of surgery, drugs, physiology, pathophysiology, and patient safety ideally position us to expand the CRNA role to postop management and do so masterfully.

You might argue that floor nurses can activate the rapid response team if there is a problem or concern. However, the evidence supporting their effectiveness is low; they are reactionary and not preventive by design. In many cases, a precipitous downward spiral that may have been interrupted with earlier oversight results in failure-to-rescue. A case of too little, too late?

In 2024, Sessler urged his colleagues to step up and assume postoperative care as a focus of their practice, creating a new branch of anesthesiology that expands their Umwelt before it’s too late. He believes “tens of thousands of lives” could be saved yearly. Even before Sessler’s call, this was apparent to us, based on the significant intensivist roles that CRNAs demonstrated outside the OR during the COVID-19 pandemic.

You might further suggest that our career cup is full. That somewhat myopic view ignores how CRNAs have innovatively expanded and demonstrated mastery of their Umwelt. Consider their enormous successes as independent practitioners in acute pain management, chronic pain management, and ambulatory ketamine clinics treating a variety of conditions, including PTSD, depression, fibromyalgia syndromes, and anxiety. Also, consider our expertise in diagnostic ultrasonography, telehealth integration like virtual consultations with patients, as aestheticians, and a wide range of independent practice opportunities that just a few years ago seemed unlikely. Our Umwelt of a decade ago was just a fraction of what it is today.

Since Galileo’s 1609 discovery of our moon’s craters, our understanding of the cosmos has expanded by many orders of magnitude. Research and ever-more-powerful land telescopes, space probes, and the Hubble and James-Webb space telescopes have expanded the human understanding of the universe nearly back to its beginning.

Likewise, CRNAs have mastered our evolving Umwelt. We should not permit others to constrain us, but rather allow research, innovation, and our expertise to guide us into practice domains where we can most meaningfully contribute. Should we continue to expand our Umwelt? We believe so.

Your Umwelt is growing—make sure your knowledge is too. Browse APEX’s CRNA continuing education courses to help support your growth as a CRNA.

Is walking 10,000 steps per day doing anything for us? In Outliers, Malcolm Gladwell famously asserted that 10,000 hours of practice are required to achieve expertise. Although he has since qualified this claim, his conclusion was based—albeit inaccurately—on the work of Swedish psychologist K. Anders Ericsson. Ericsson studied elite violinists who had accumulated approximately 10,000 hours of practice by age 20, but his findings were taken out of context.

Gladwell’s declaration that “10,000 hours is the magic number of greatness” extends far beyond the scope of Ericsson’s original research. To put it politely, we might say: Mr. Gladwell, with all due respect, we are grateful that you are not interpreting clinical anesthesia literature on our behalf.

There are many ways to critique this oversimplification. Working 40 hours per week for five years yields 10,000 hours—but time alone does not create expertise. Ericsson himself emphasized that mastery requires deliberate, focused practice with ongoing refinement, not simply accumulated hours. Gladwell’s narrative reduces a nuanced developmental process into a misleading soundbite.

The number 10,000 comes up in many areas of history and culture. Just a brief sampling includes:

- The number appears over 40 times in the Bible.

- In 1978, 10,000 was the world record, by an American, for correctly memorizing the order of digits in the mathematical constant pi (that record was subsequently broken).

- It is used frequently in literary works to symbolize something innumerable.

- 10,000 is an even composite number composed of two prime numbers multiplied and has 25 dividers; it’s a Harshad number, meaning that the sum of its digits (i.e., 1) is a divisor of 10,000 itself.

- It’s often used in math puzzles and games as its square root is 100.

- In Chinese literature, the term “wansui” appears frequently, referring to its literal meaning of 10,000 years, which implies a very long life.

- The Japanese corporation Yamasa™ developed the first pedometer in 1964, following the Tokyo Olympics. They called it a manpokei, translated as “10,000 step meter,” 44 years before Gladwell’s 10,000 axiom.

- The Roman numeral for 10,000 holds a special place and is denoted as X̅.

- Many of us use it in a pro or con argument when we retort, “Well, I could give you 10,000 reasons why…..”

There appears to be something inherently compelling about the number 10,000 for Homo sapiens—the species name science has assigned to us. Although Homo sapiens translates from Latin as “wise humans,” one might question whether we’ve earned that designation, given our recurring attraction to axioms that often rest on shaky foundations.

Achieving health with a daily milestone

This preamble brings us to what we want to interrogate—a number we should target daily to promote our health—getting 10,000 steps per day during our waking hours. Those who substantially somnambulate may also include those steps, although this may necessitate a tracking device for proof, given that you will likely be amnestic for the event. They may also wish to wear a helmet at bedtime for self-preservation.

We all know that regular exertional activity is a key facet of a health maintenance or health improvement program. The benefit of physical activity conveys measurable health benefits and can substantially improve the quality of life that one enjoys. In those with cardiovascular disease, diabetes, obesity, depression, and even certain cancers, its effects can be substantial when combined with nutrition, lifestyle modifications, and health professionals’ guidance.

Keeping track of steps is a simple, easily calculated number to quantify the physical activity of walking, whether we actively count them (dauntingly laborious) or use a device such as a fit-watch or even the app likely residing on your cell phone. It’s also a quantifiable target that can be targeted. The 10,000-step quest has gained widespread, if not global, access to our collective consciousnesses and is tenaciously pursued by many. Let’s look at what putting it to a testable hypothesis reveals.

10,000 and the influence of variability

Before we go down the rabbit hole of scientific proof—or its absence—of 10,000 steps per day, how far will 10,000 steps take us? And about those steps, does a hill or two or three have an impact? What about if those steps include steps in the form of stair steps or speedy ones? And what if one decides to employ rucking—do you even know what ‘rucking’ is? So many questions before we can even really think about the science.

Our inherent morphological variability

Back to homo sapiens, where variability in body architecture tends to be the norm vs the exception. We vary in height and leg length, and compounding the accuracy of any quantitative analytics, some of us take shorter steps while others take longer ones. Just as we generally see drug doses and physiological parameters in textbooks based on a 70 kg male (apologies to all females, but rest assured, this paradigm is finally beginning to change!), finite translation of steps to miles is variable, but generally 10,000 steps seem to fall in the vicinity of 4 to 5 miles or about two hours of walking. But even this translation can be quite imprecise. When age, sex, comorbidities, race, diet, and baseline fitness are factored in, such generalizations can become a house of cards.

And terrain—and the associated physics—plays a role as well. Walking up an incline requires lifting each step a bit higher, picking it up from a lower point against gravity compared to what occurs on level ground. The physical work is amplified not just from that required to move us forward but also from that needed to lift, created by Earth’s mass. Factor rucking into the equation, a physical activity with roots in the military, and you’ve added a backpack with weight (again variable), further complicating work effort, and requiring an additional calculus.

What research reveals about 10,000 steps per day

We’ve attempted to demystify the number 10,000 a bit, putting it in cultural and scientific contexts, noting that many factors can make definitive translations haphazard. With that in mind, let’s look at what we believe are a couple of the better studies examining the 10,000 steps per day regimen and its implications.

We like well-done meta-analyses (MAs), as they can illuminate a question that needs answering by pooling research studies. Ideally, MAs consider only high-quality studies (avoiding the “garbage-in, garbage-out” phenomenon) using stringent and objective methods to report an overall summary effect of an intervention. We also like large-sample trials that include and control for many variables and provide generalizable conclusions. With these biases noted, let’s look at a few of our representative selections.

- A recent MA using electronic daily step counts examined the association between all-cause death, cardiovascular (CV) morbidity or mortality, and glucose metabolism. All involved adults ≥ 18 years with follow-up ranging from 3 months to 10 years. Over 30,000 subjects in 17 studies were included in the analysis. For every 1,000 steps taken daily, increased from baseline, there was a decrease in risk of all-cause deaths, CV morbidity, and mortality. Glucose metabolism effects were less clear because it was inconsistently measured. Health benefits were seen below 10,000 daily steps, finding that walking an additional 1,000 steps per day conveyed benefits in a dose-dependent fashion.

- A prospective study involving over 72,000 adults (mean age: 61 years) was conducted to assess the impact of daily step count and sedentary behavior on health outcomes. Participants were stratified by electronically recorded sedentary time into two groups: <10.5 hours vs ≥10.5 hours per day, excluding sleep. During follow-up, there were 1,633 deaths and 6,190 major cardiovascular events. The greatest health benefit was observed in those taking 9,000 to 10,500 steps daily and exhibiting low sedentary time. Notably, a protective effect began to emerge at 4,000–4,500 steps per day. The authors concluded that any step count above the baseline average of 2,200 conferred health benefits, underscoring a clear dose-dependent relationship.

- A prospective cohort study published in JAMA examined over 2,000 Black and White adults aged 38–50, tracking them for nearly 11 years to assess associations between daily step counts and premature mortality. Participants wore digital step trackers and were stratified into three groups based on daily step volume: low (<7,000), moderate (7,000–9,999), and high (>9,999). The findings revealed that individuals taking at least 7,000 steps per day had significantly lower all-cause mortality compared to those with fewer than 7,000 steps. Importantly, step intensity—defined by stepping rate—was not associated with mortality risk.

All these studies have serious limitations. They are all observational, making causality impossible. Subjects taking the fewest steps tended to be those with moderate to serious baseline comorbidities. Even in the larger studies, death was a relatively rare event, precluding drawing bullet-proof associations with step count, age, sex, race, etc. Also, electronic trackers all have inherent weaknesses, and trackers were not standardized or calibrated in all the studies.

What are we to conclude about 10,000 daily steps?

We are amidst an epidemic of physical inactivity, and the toll is sobering. We are witnessing an ever-increasing rate of obesity, chronic metabolic and cardiovascular disorders, as well as psychological ailments, especially depression, PTSD, and anxiety, in the general population. While physical activity is heralded as an actionable salubrious pursuit, it is not the sole elixir to all our ills.

The American Heart Association includes verbiage on its website under the heading, “Is 10,000 steps really a magic number for health?” While the AHA does not endorse the pursuit of “10,000” as a proven remedy, it notes: “It’s a nice clean number and makes a good marketing message. You can see why it sticks, but there is not a lot of science behind it.”

The figure of 10,000 steps is largely arbitrary—perhaps appealing because it resonates subconsciously as a round, memorable goal. Nevertheless, it has gained traction, fueling the marketing of fitness trackers, including those from the original Yamasa™ company, which now incorporate features such as caloric expenditure and physiologic monitoring. While 10,000 steps may seem aspirational or even intimidating to some, the encouraging news is that—even though the supporting science remains somewhat limited—step counts above 2,200, especially when gradually increased, appear to be associated with reduced mortality and lower risk of cardiovascular complications.

There is neither magic nor folly in getting 10,000 daily steps, any more than is the axiom we should endeavor to get a good night’s sleep. Rather, it is best viewed as one of many titratable and actionable interventions to foster a healthful quality of life. Doing a few more steps each day is low-cost, low-risk, can be done solo or with others, and gets you out of the house. Exercise does not have to be miserable to count.

As CRNAs ourselves, we understand the challenge of fitting CRNA continuing education credits into your busy schedule. When you’re ready, we’re here to help.

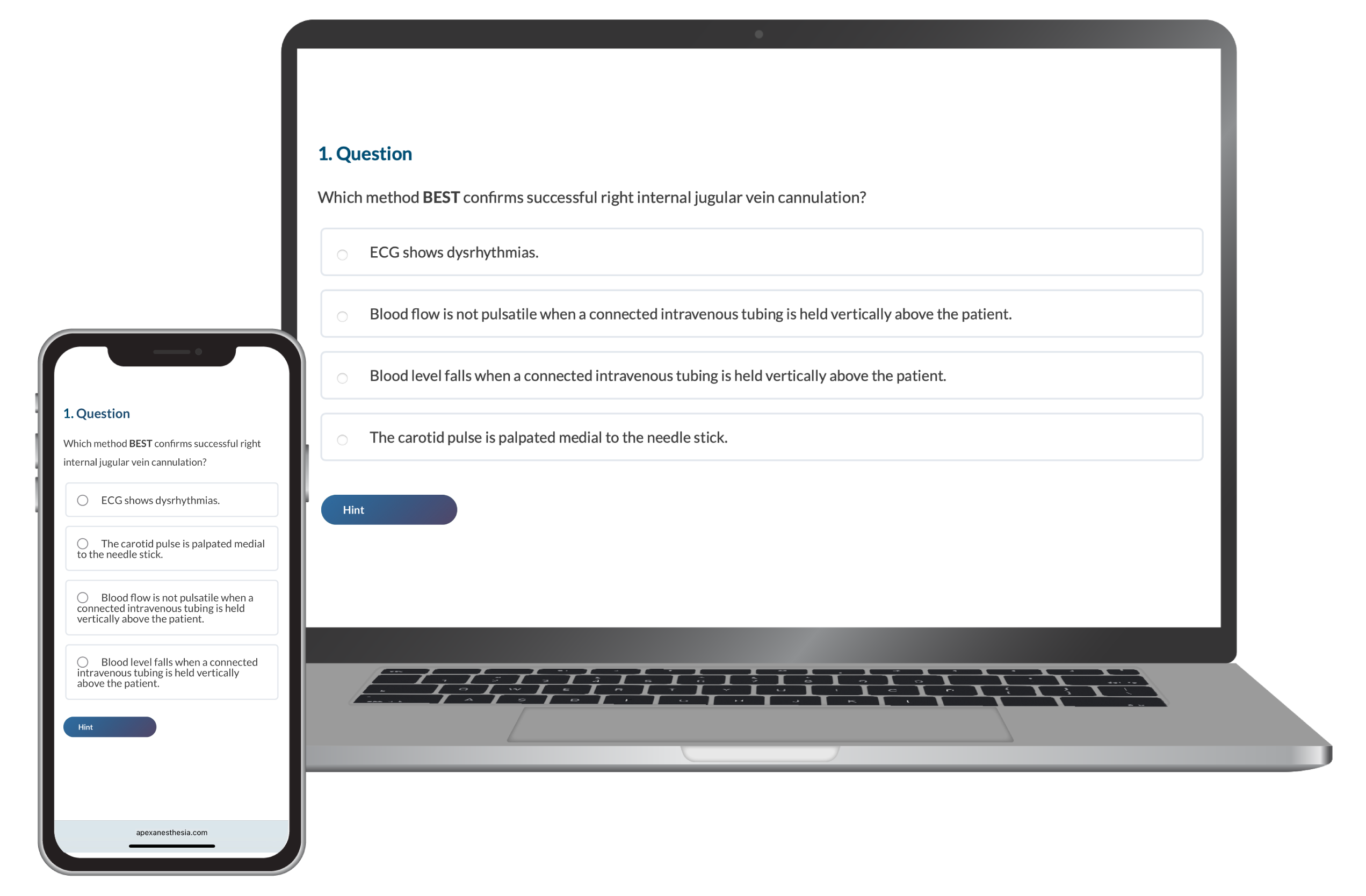

With the launch of the Maintaining Anesthesia Certification (MAC) Program by the National Board of Certification and Recertification for Nurse Anesthetists (NBCRNA), we recognize that you might have concerns. Rest assured, we are here to equip you with the information you need to succeed. Consider this your first step toward preparing for MAC Check questions, the MAC Program’s new assessment.

Understanding the NBCRNA MAC Check

The NBCRNA MAC Program consists of three components: MAC Ed (Class A credits), MAC Dev (Class B credits), and the MAC Check.

Though MAC Ed and MAC Dev may be familiar, the MAC Check is entirely new. It’s a longitudinal assessment (LA) that replaces the Continued Professional Certification Assessment (CPCA).

The self-paced platform administers multiple short assessments over 13 quarters to measure and solidify your core CRNA knowledge. You’ll receive item feedback, rationale, and identify areas of improvement to help improve your understanding.

It’s important to note that although the MAC Check is not a pass/fail assessment, adequate preparation is key. If you do not meet the performance standard, you must earn additional MAC Ed credits in the core MAC Check domain prior to your next certification renewal, which can be time-consuming and costly, and may delay your recertification.

To learn more about the MAC Program, click here.

Key Content Areas to Focus on for CRNA MAC Check Prep

There are four main content categories you should study for the MAC Check.

- Airway Management (34%)

- Applied Clinical Pharmacology (24%)

- Applied Physiology and Pathophysiology (24%)

- Anesthesia Equipment, Technology, and Safety (18%)

Review the NBCRNA MAC Check Outline for an in-depth topic breakdown and examples that help clarify content on the longitudinal assessment.

3 Highly Effective Study Strategies for the MAC Check

NBCRNA’s research study, “Transforming Assessments of Clinician Knowledge: A Randomized Controlled Trial Comparing Traditional Standardized and Longitudinal Assessment Modalities,” found that the longitudinal assessment is more conducive to lifelong learning. Because of the assessment’s unique nature, your study approach may differ from that of standard assessments.

1. Take practice questions

We recommend employing a question bank to practice MAC Check questions, in addition to completing the MAC Check sample. Qbanks are essential to familiarizing yourself with the assessment’s format and content.

The CRNA CE Mastery Qbank is a simple way to prepare for the MAC Check and earn Class A credits at the same time. It has 25 quizzes covering the essentials of CRNA practice, includes in-depth explanations for each question, and helps you identify knowledge gaps. You’ll also earn 1 Class A credit for every quiz you pass.

2. Use active studying methods

The NBCRNA’s bibliography is a valuable resource for reviewing information, as these sources were used by MAC Check item writers. However, recent studies have shown that active learning yields better outcomes than passive methods alone.

Rather than reviewing notes, reading textbooks, and watching instructional videos, try active study methods to engage with and master what you’re learning. Some standard techniques include:

- Recall: Use digital flashcards to test your knowledge and practice recall. Active recall strengthens neural connections to memories.

- Spaced repetition: Space out your studying over time to increase long-term retention of information. It’s more effective than cramming. A typical schedule includes reviewing the topic again after one day, then three days, seven days, 14 days, and so forth.

- Self-testing: Practice questions help gauge your knowledge and progress. Use your results to help you develop a study plan tailored to your specific needs and enhance your overall performance.

3. Focus on areas of improvement

We understand that CRNAs are often limited on time—that’s why your study plan has to be efficient. Make the most of studying by reviewing content areas you’re not confident in.

Remember, the MAC Check provides helpful rationale and feedback. Use it to fill your knowledge gaps and improve your performance in the next MAC Check quarter.

Sign up for APEX Anesthesia Review

If you need help studying for the MAC Check or simply meeting your MAC Program requirements, APEX Anesthesia Review offers everything you need in one place. Our online anesthesia courses award Class A, or MAC Ed, credits all while fitting within your busy schedule.

If you’re considering the jump from W-2 employment to working 1099 as a CRNA, you’re not alone. The promise of more money, schedule flexibility, and personal freedom draws many CRNAs into independent contracting. But with that freedom comes responsibility. You’re no longer just showing up and getting paid. You’re running a business.

This guide answers the key questions every CRNA should ask before accepting a 1099 role. We’ll cover taxes, legal setup, retirement options, insurance needs, and how to avoid common mistakes. Whether you’re testing the waters or ready to go all in, this is your starting point.

Table of Contents

- W-2 vs 1099

- Understanding 1099 Taxes

- Do You Need a Business Entity

- Keeping Finances Separate

- Hire the Right CPA

- Retirement Strategies

- Insurance and PTO

- Legal and Contractual Risks

- Managing Income Variability

- Must-Have Backend Systems

- Protecting Yourself from Recruiters

- How to Transition to 1099

- Understanding Job Security

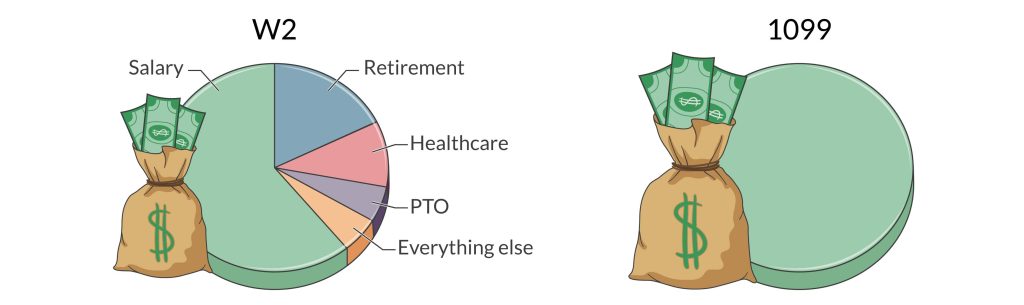

1. What’s the Real Difference Between W-2 and 1099?

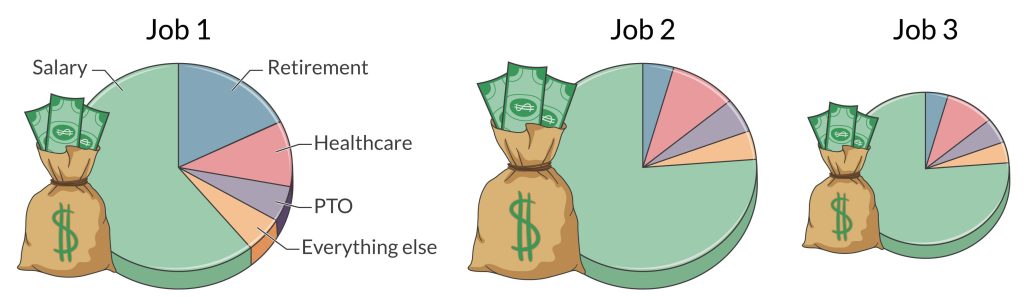

A W-2 CRNA is an employee. Taxes are withheld from your paycheck. Your employer may provide health insurance, malpractice coverage, a retirement match, and paid time off. You follow their schedule and face minimal administrative burden.

A 1099 CRNA is an independent contractor. You negotiate your pay, set your schedule, and manage everything behind the scenes—taxes, benefits, contracts, and compliance. You often earn more per hour, but you take on more risk and responsibility.

2. Understanding 1099 Taxes

When you go 1099, your tax responsibilities change significantly.

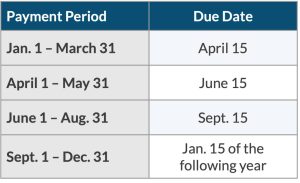

Estimated Quarterly Taxes

Unlike W-2 employment, taxes are not withheld from your pay. You must estimate and pay your federal and state taxes four times annually. The table below details when federal payments are due. State due dates don’t always align with the federal schedule.

Work with your CPA to calculate how much to pay each quarter based on your projected income. Many CRNAs set aside 25–35% of their income to cover taxes.

You can pay the IRS through the Electronic Federal Tax Payment System (EFTPS) or by mailing in Form 1040-ES. State estimated taxes are paid separately. Automating this process through your CPA or trusted tax software helps ensure accuracy and consistency.

Self-Employment Taxes

As a 1099 independent contractor, you’re considered self-employed. This means you’re on the hook for self-employment taxes, which are 15.3% of your net income. Net income equals income after deductions, highlighting the power of reducing taxable income through deductions (we’ll explore these in a later section). Here’s what’s included in self-employment taxes:

- 12.4% Social Security tax

- 2.9% Medicare tax

- 0.9% Medicare surtax for earnings above $200,000 (single) or $250,000 (married filing jointly).

You can deduct half of your self-employment tax when calculating your adjusted gross income (AGI), reducing your federal tax burden.

1099-NEC Forms

Instead of receiving a W-2 during tax season, each facility or anesthesia group paying you $600 or more annually will issue a separate 1099-NEC by January 31. Keep all these forms organized, and carefully track income throughout the year, verifying accuracy as you receive each form.

Tax Deductions

Business-related deductions are one of your most valuable financial advantages as a 1099 CRNA. Again, this article is for educational purposes only, and you should consult with your CPA to discuss your unique situation.

Also, here’s a common misunderstanding. Something is not necessarily tax-deductible just because your CPA says so. Although a CPA can provide valuable tax advice and guidance, it’s your responsibility to ensure that any deductions you claim are legitimate and supported by law and proper documentation. Tax attorneys can also provide expert guidance, but regardless of the guidance you receive, the IRS will have the final say in the event of an audit.

3. Do You Need a Business Entity?

Yes (in nearly all cases). Without one, you’re a sole proprietor, which means you and the business are considered one and the same. That means you won’t have liability protection, and your personal assets are at risk if someone sues your business.

Limited Liability Company (LLC)

An LLC offers liability protection and separates business from your personal finances. It also helps you establish a professional image with clients. In some states, a Professional Limited Liability Company (PLLC) may be a better option, so discuss this with your CPA. We’ll use LLC and PLLC interchangeably throughout this article.

S-Corp Election (LLC taxed as S-Corp)

Once your income reaches a certain threshold, electing S-Corp status may save you money on self-employment taxes by splitting your income into salary and distributions. This structure requires payroll processing and formal recordkeeping.

Here’s a list of other things you’ll need to keep your business legit:

1. Form the LLC Properly

- Choose an available business name

- Must be distinguishable and comply with your state’s LLC naming rules

- Check the USPTO to ensure the name does not have a federal trademark

- File Articles of Organization

- File with your Secretary of State

- Pay Filing Fee

- Varies by state (typically $50–500)

2. Get Identification and Records in Place

- Apply for a free EIN (Employer Identification Number)

- Create an operating agreement

- Not always required, but strongly recommended (especially with multiple members)

- Defines roles, ownership percentage, profit distribution, dispute resolution, and exit plans

3. Register for Any Required Local, State, or Federal Licenses

- Business licenses or permits

- May vary by state

- Professional licenses

4. Maintain Financial Separation

- Open a business bank account

- Never co-mingle personal and business funds

- Get a business credit card

- Builds credit and helps separate finances

- Set up accounting software or system

- For taxes, expenses, and income tracking

5. Other Considerations

- Register a registered agent

- Can be you, another person, or a company who accepts legal documents

- File foreign registrations

- If you do business in multiple states

- Insurance (research each to determine what’s best for you)

- Malpractice

- Professional liability

- Disability

- Life

- Workers’ comp

- Stay compliant over time (e.g., renewing your LLC, filing annual reports)

- Pay quarterly taxes

4. Keep Business and Personal Finances Separate

Separate your business and personal finances. All income, expenses, and tax payments should go through a dedicated business checking account. This keeps your records clean, simplifies tax filings, and makes navigating audits easier.

Business bank accounts also protect your legal structure. If you operate as an LLC or S-Corp and mix personal and business funds (often referred to as “co-mingling”), you risk “piercing the corporate veil.” This legal term means a court could disregard your business structure and hold you personally liable in a lawsuit against your business. The whole point of forming an entity is to protect your personal assets. Co-mingling funds breaks that barrier. Keep it clean.

Here’s an example of how to set up your accounts.

5. Hire the Right CPA Early

Once you decide to go 1099, you should form a relationship with a certified public accountant (CPA). This sets the foundation for your 1099 success by ensuring you’re making the right moves from the start.

The right CPA will:

- Help you choose the right business structure

- Calculate and schedule your quarterly tax payments

- Ensure compliance with state and federal tax laws

- Maximize deductions to reduce taxable income

- Set up and manage your retirement strategy

Choose someone with experience advising 1099 CRNAs or self-employed healthcare professionals. Some CPAs view their jobs as simply helping you file your taxes. The best ones help you with a comprehensive strategy to help you build wealth.

6. Retirement and Wealth-Building Strategies

As a 1099 CRNA, you have more retirement options and higher contribution limits than you did as a W-2 employee. These tools can help you reduce your tax burden while building long-term wealth. Depending on the vehicles you use, you could potentially save tens of thousands of dollars annually.

Solo 401(k): Allows contributions as both employee and employer, up to $69,000 annually (2024 limits). Contributions reduce taxable income.

Defined benefit plan: Acts like a personalized pension. Offers even larger contribution potential. Best suited for high earners. Requires actuarial support and a multi-year commitment. More expensive to administer but the tax savings are well worth it.

Backdoor Roth IRA: Allows high-income earners to access Roth IRA benefits. Coordinate carefully with your CPA to avoid triggering unexpected taxes.

Qualified business income (QBI) deduction: Allows eligible 1099 contractors to deduct up to 20% of their net business income. Only applies to certain types of income and phases out at higher income levels, so consult a tax professional to determine eligibility.

Health savings account (HSA): Triple tax benefit: 1) contributions are tax-deductible; 2) growth is tax-free; and 3) withdrawals are tax-free if used for qualified medical expenses. Paying for health expenses out of pocket (e.g., not dipping into your HSA) allows this money to compound over time.

S-Corp income splitting: If your LLC is taxed as an S-Corporation, you can split your income between a W-2 salary and owner distributions. You pay full payroll taxes on the salary portion, but distributions are not subject to self-employment tax. For example, if you earn $240,000, you might pay yourself a $130,000 salary and take the remaining $110,000 as a distribution, saving thousands in payroll taxes. This strategy can lead to significant tax savings, but you must pay yourself a “reasonable” salary. Your CPA will help determine an appropriate amount. Paying yourself too little to avoid taxes increases your risk of audit and back taxes.

These strategies can save you thousands of dollars in taxes each year and help you build lasting financial security. Work with a CPA or advisor who understands the unique needs of CRNAs to tailor the right approach for your business.

7. Insurance and Paid Time Off

You’re responsible for replacing all the benefits your employer previously provided. For an in-depth analysis of this topic, check out this article: Understanding CRNA Compensation and Benefits: It’s More Than Your Salary. At a high level, this includes:

Health insurance: Explore private plans, ACA marketplace options, or coverage through a spouse.

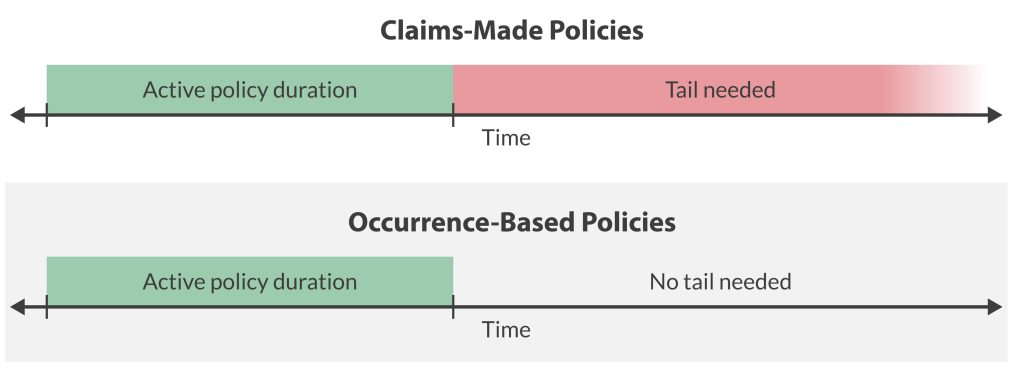

Malpractice insurance: Confirm policy type (occurrence or claims made), limits, and whether tail coverage is required.

Business liability insurance: Consider general or professional liability insurance to protect against non-clinical claims, especially if you operate as an LLC or S-Corp.

Disability and life insurance: Prioritize own-occupation disability coverage and term life insurance.

Paid time off: You won’t get paid when you’re not working, so budget for vacations, sick days, and unexpected downtime. It’s easy to discount the financial value of PTO (PTO value = Hourly rate × # hrs PTO). For instance, if your full-time W-2 salary is $225,000 and you get 8 weeks (320 hrs) of PTO, then the value of your PTO is ~ $35,000 ($110/hr × 320 PTO hrs). If you wanted 8 weeks off as a 1099, you’d need to factor this in to your billing rate (along with all of your other expenses).

The bottom line is that you need to build the cost of these benefits into your hourly rate and savings plan.

8. Legal and Contractual Risks

Before signing any 1099 agreement, carefully review the contract. Some CRNAs seek legal counsel, whereas others wing it. The recurring theme is that this decision comes down to your risk tolerance. Key areas to evaluate include the following:

- Cancellation clauses and termination notice

- Payment terms, including rate, frequency, and method

- Call and weekend expectations

- Whether malpractice insurance is provided or required

- Restrictive covenants such as non-compete clauses

- Indemnity clauses that shift legal responsibility for facility errors to you

- Non-solicitation clauses that may prevent you from working directly with a facility after a contract ends. Review carefully to avoid limiting future opportunities.

Some employers misclassify CRNAs as independent contractors (when they’re treated as W-2 employees) to save money on taxes and benefits. So, beware of long-term roles that function like W-2 jobs. The IRS is watching.

If the facility dictates your schedule, controls how you work, and restricts outside employment, the IRS may consider the role misclassified. If the IRS discovers misclassification, it can trigger audits, back taxes, and penalties for the employer (not you). But even if the employer is typically held liable, a misclassified CRNA may face loss of unemployment eligibility, difficulty collecting back pay, and potential tax confusion if reclassified retroactively.

9. Managing Income Variability

As a 1099 CRNA, you’ll experience income fluctuations. Build a buffer and plan ahead.

- Emergency fund: Save 3–6 months of essential expenses. Whether you’re the sole breadwinner or you have a partner with a stable income will influence your risk tolerance.

- Tax savings account: Transfer 25–35% of every payment to a separate account for taxes. Whatever is left over at the end of the tax year is yours to keep.

- Retirement contributions: Make automated, monthly contributions to stay consistent.

- Cash flow tracking: Use bookkeeping software or a spreadsheet to monitor income, expenses, and upcoming obligations.

Staying disciplined with money management protects your long-term stability.

10. Must-Have Backend Systems

You’ll need to run your business like a business. Set up these systems before you start:

- Separate business bank accounts: We discussed this earlier, but it bears repeating. Never mix business and personal funds! At a minimum, you should have business accounts for checking (for operational expenses) and savings for estimated taxes.

- Bookkeeping software: QuickBooks, Wave, Gusto, or a spreadsheet for tracking income and expenses. You can also use software to run payroll if you’re an S-Corp.

- Invoicing tools: Use professional templates or software to send timely invoices.

- Digital filing system: Organize contracts, licenses, receipts, and insurance documents for easy access and audit protection.

11. Protecting Yourself from Recruiters

Although many recruiters offer helpful opportunities, a few bad actors use tactics that hurt CRNAs and damage the reputation of the profession as a whole. Recruiters work for the agency, not for you. Protect your interests by being selective (research the CRNA forums online), asking tough questions, and getting everything in writing.

- Watch for rate suppression: Some recruiters deliberately offer below-market rates to keep more margin for themselves. Although they’re providing you a service (and deserve to get compensated), know your worth by benchmarking current regional pay.

- Avoid exclusivity clauses: Never sign contracts that restrict you from working with other agencies or facilities unless you’re compensated appropriately.

- Confirm malpractice coverage: If a recruiter claims to provide malpractice insurance, request the policy details in writing. Always verify limits (these vary among states), tail coverage, and whether the policy names you directly.

- Ask for full contract details upfront: Don’t accept vague job descriptions. Request a full contract before committing and read all terms, not just the pay rate. Some recruiters will request your resume before sharing job details. Be wary of this practice.

- Maintain your own network: Build direct relationships with facilities and trusted agencies. Relying on a single recruiter creates an unnecessary dependency.

- Protect your phone number: They’re going to text you, in some cases a lot! Only share your phone number after you’ve vetted the recruiter.

Stay in control of your professional identity. Keep a record of where your resume goes and who is representing you at each site.

- Watermark your resume: Add a discreet watermark with your name, contact info, and a statement like, “This resume is provided exclusively for consideration by [Facility Name]. Unauthorized distribution prohibited.” This discourages recruiters from shopping your resume without consent.

- Tailor your resume per submission: Create a separate PDF version for each opportunity with the facility’s name in the file name and body text. This clarifies that the document was submitted for a specific role and can help resolve disputes about who submitted your resume first.

- Control your resume: Never allow a recruiter to submit your resume to a facility without your explicit written permission. Some agencies will “claim” you at a facility by submitting your name without consent, which can block other recruiters (or even you) from applying directly.

- Use a disclosure policy: Ask to review and sign an agency’s disclosure agreement stating that they will not submit your information without prior approval. Keep written records of when and where your resume is submitted.

- Know the consequences of multiple submissions: If multiple agencies submit your resume to the same facility, some facilities will disqualify you from consideration entirely. Others may default to the first recruiter who presented you, which could lock you into a lower rate or less favorable terms.

12. How to Transition to 1099 Smoothly

You don’t need to go full-time 1099 overnight. Start small and scale as you become more confident that it’s the best path for you. Here are several things to consider:

- Accept PRN or short-term contracts first. If you moonlight, be sure you’re not violating your contract with your W-2 employer. Use your experiences to test your systems and gain experience.

- Work with your CPA to run tax projections and retirement planning before leaving your W-2 job.

- Ensure your state license, DEA registration, and credentialing files are current and complete before accepting your first 1099 contract. Some facilities require lengthy onboarding.

- Secure malpractice coverage before you work. Don’t wait until a contract is signed. Purchase your own malpractice policy early, especially if you’re working across multiple sites or states.

- Create a reusable file packet that includes your W-9, COI (certificate of insurance), CV, licenses, and other required documents. This streamlines your response to recruiters and facilities.

- Set a target hourly rate before negotiating. Know your breakeven rate, the amount you need to cover taxes, benefits, overhead, and personal financial goals. This helps you avoid undervaluing your services. On the flipside, understanding the economics of the local market will help you get a sense of your true value.

- When you’re offered a 1099 contract, you’ll often see two types of pay structures: hourly rate plus stipend to cover expenses (housing, travel, etc.) or all-inclusive rate. Work with your CPA to determine how each scenario impacts your tax liability and take-home pay. A seemingly higher all-inclusive rate may actually result in less after-tax income than a lower hourly rate paired with well-structured stipends. There’s no answer that’s always best, so evaluate each offer independently.

- Talk to other 1099 CRNAs. Ask about lessons learned, agencies they like, and red flags they’ve encountered.

Start with strategy, not urgency. The transition is smoother when it’s planned.

13. Understanding Job Security as a 1099 CRNA

One of the most overlooked tradeoffs of 1099 work is job security. When you’re a W-2 employee, you have more structural protection. Your schedule, income, and benefits are generally stable unless the facility goes through layoffs or restructuring. Even then, you may receive notice, severance, or be eligible for unemployment benefits.

By contrast, 1099 work is inherently less secure. As more CRNAs enter the 1099 market (supply side increases), there is greater competition that can drive down rates. Contracts can be canceled with little notice. Shifts may dry up. Facility needs can change overnight. CRNAs practicing during the economic recession of 2008 may recall that many 1099 positions disappeared virtually overnight in many parts of the country. Although no one can predict the future, history has a way of repeating itself.

Finally, since you’re not considered an employee, you have fewer legal protections and you’re generally not eligible for standard unemployment benefits. This doesn’t mean 1099 is too risky. It just means you need to execute a sound strategy.

Final Thoughts

Working as a 1099 CRNA can unlock more income, freedom, and long-term financial security, but only if you treat it like a business. With the right systems, support team, and mindset, you can take control of your career in a way most W-2 roles can’t support.

Start by investing in the right guidance, building your financial infrastructure, and planning your transition carefully. Your future self will thank you.

Check out the APEX Job Board when you look for your next W-2 or 1099 opportunity.

You’ll spend over 30% of your adult life at work. For CRNAs, the right job can mean freedom in your practice, respect from your team, and a life outside the hospital. The wrong one? It can leave you overworked, undervalued, and questioning why you chose this path in the first place.

If you’re serious about finding a job that matches your goals, you need a better strategy and platform. Unlike most other job boards, the APEX CRNA Job Board was created by CRNAs for CRNAs. It’s built with a deep understanding of what matters most to you.

In this guide, we’ll show you how to use job boards intentionally and why the APEX Job Board was built to do what others don’t—help CRNAs and SRNAs land the best job for them.

Table of Contents

- CRNA Job Search

- Using a Job Board

- Apply with Intention

- Setting Job Alerts

- Reaching Out to Employers

- Send Us Feedback

1. CRNA Job Search Strategy: Get Clear About Your Goals

Most job searches start in the wrong place, mindlessly scrolling through countless job listings. But if you don’t know what you want, every job starts to look the same.

Before you open a job board, take 10 minutes to define what a great job looks like for you. This will save you hours of searching and help you spot the right opportunity when it shows up.

Understand that there’s no such thing as a universally “perfect” job. Some of you will prioritize salary to repay student loans or build a nest egg, while others might focus on quality of life or being able to practice at the top of your license. You can have any of these things, but few jobs will give you everything. Figure out what matters most to you (not what you’re told you should care about on social media).

Questions to ask yourself:

- What’s the minimum salary I’ll entertain (remember, you’re better off looking at the value of your total compensation package and not just the salary)?

- Am I willing to work with recruiters, or do I only want to engage with employers directly?

- Do I want a W-2 or 1099 role?

- How do I want to work (full time, part time, per diem, or locum tenens)?

- What’s my ideal location, and am I open to relocating (consider cost of living, commute time, etc.)?

- What benefits are most important to me (lots of PTO, great health insurance)?

- Do I want autonomy or a team-based environment?

- What type of cases do I want (bread and butter, cardiac, OB, trauma, etc.)?

- What shift options do I want (shift work, nights, weekends, call frequency, etc.)?

- What type of practice model do I want (medical direction, medical supervision, CRNA independent)?

- What type of workplace culture do I value?

Based on your answers, you’ve essentially written your ideal job description. Now, it’ll be easy to match the jobs you find to your ideal situation.

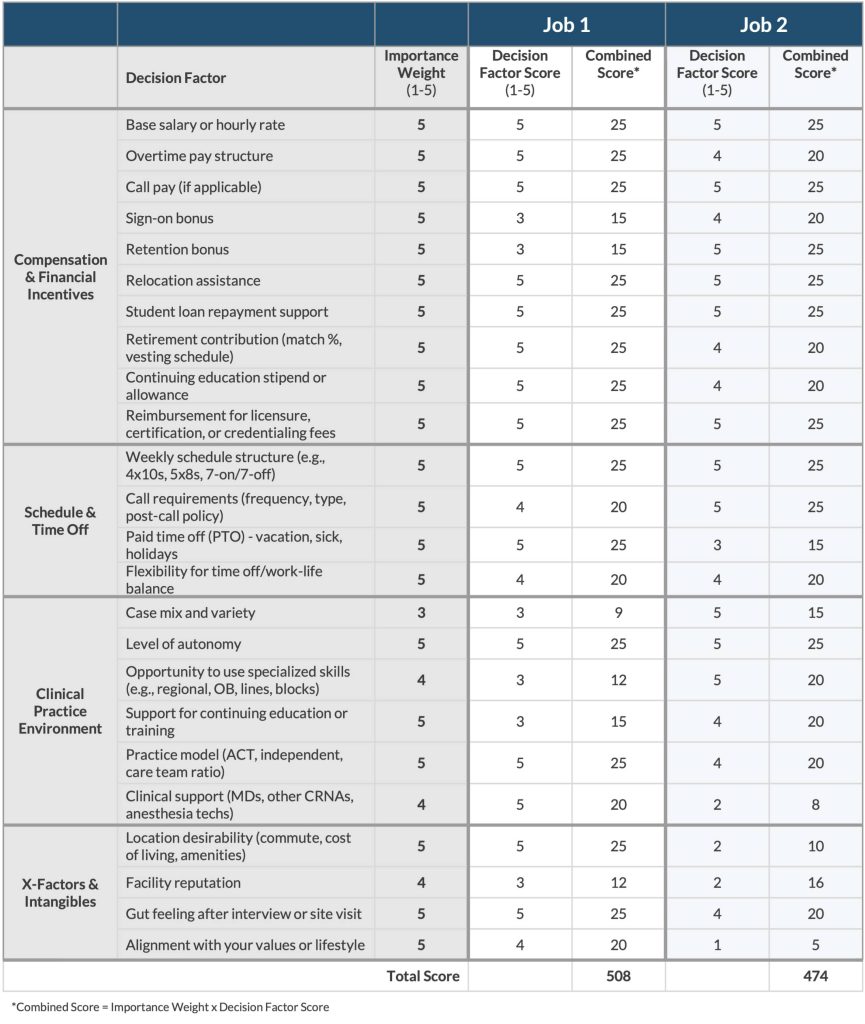

If you want to go a step further, you can create a priority matrix that gives you a more objective comparison for each job you’re considering. Here’s how to do it, followed by an example of what it should look like:

- For each decision factor, assign a score that indicates how important this factor is for you (importance weight).

- For each job, assign a score for how that job ranks for each decision factor (decision factor score).

- Multiply the importance weight score and the decision factor score for a given job. This will give you the combined score for that decision factor.

- Add all the combined scores to arrive at the total score for each job. Now you’ll have a quantitative assessment of each job so you can make more of an apples with apples comparison.

When you’re clear on your must-haves and dealbreakers, you stop wasting time chasing jobs that don’t serve you.

2. Use a Job Board That Prioritizes Search and Transparency

Most job boards aren’t built with the CRNA search experience in mind. This leaves you stuck sorting through irrelevant listings and wasting valuable time.

That’s why we use smart tags so that you can find the most relevant jobs fast.

The APEX Job Board lets you filter by:

- Location

- Salary range

- Who’s posting the job (direct employer, recruiter, or staffing agency)

- Tags that matter to you (everything from special job benefits to quality of life)

- Tax status (W-2 or 1099)

- Employment type (full time, part time, per diem, and locum tenens)

- Accepts new grads (yes or no)

- Specialties and skills (regional, cardiac, peds, OB, and all the rest)

- Shift options

- Role type (clinical, chief CRNA, educator)

- Practice model

But smart tags are only half the story. The quality of the listing still depends on the employer who’s posting the job (garbage in = garbage out). That’s why we work with job posters to help them write better, more transparent job posts so you can make faster, more informed decisions.

3. Apply With Intention

Now that you’ve used smart filters to find roles that align with your goals, it’s time to shift from searching to applying.

Before you apply, take some time to learn more about each employer. How you engage with them during your first interaction will shape how they view you as a potential candidate.

- Research each facility or group.

- Tailor your resume and cover letter by highlighting clinical experiences, case types, or certifications that match each specific job, especially if the listing mentions OB, regional, or independent practice.

- Prepare a few thoughtful questions that show you’ve done your homework.

The APEX Job Board makes it easy to apply with intention:

- Every listing is CRNA-specific.

- You can save your favorite jobs to your account for easy comparison.

- Already have an APEX account? You can use it to sign in (no extra login needed).

- Each job post links to a company profile page so you can learn more about each organization you apply to.

4. Let the Right Jobs Come to You With Job Alerts

Even the most strategic search can miss a great opportunity if you’re not checking in daily. And let’s be honest, between your OR schedule, board prep, and everything else life throws at you, who has time for that?

That’s where job alerts come in.

On the APEX Job Board, you can create custom alerts based on the exact filters you care about. When a new job matches your criteria, we’ll email you.

5. Stand Out by Reaching Out

Most job boards put a wall between you and the employer. You upload your resume, click “apply,” and hope for the best. Weeks pass. No response. No feedback. Just silence.

That’s not how it works on the APEX Job Board.

We encourage employers to share their best point of contact so you can start a conversation before or after you apply—whether you want to ask a clarifying question, build rapport ahead of the interview, or get answers to things job listings rarely include, like:

- What kind of support do new hires get?

- What’s the OR culture like?

- How are schedules and PTO handled in real life?

If you want a comprehensive list of questions to ask during an interview, check out our article: Smart Questions to Ask In a CRNA Job Interview.

Your job search isn’t just about applying; it’s about building relationships. We’ll help you do that on the APEX Job Board.

6. Help Shape the Future of the APEX Job Board

Because the APEX Job Board was built by CRNAs, for CRNAs, your voice matters.

We’re constantly evolving the platform based on feedback from the CRNA and SRNA community. If there’s a feature you’d love to see or something that would make your job search easier, we want to hear it.

Have a suggestion? Send us your ideas. Together, we’ll build the job board our amazing profession deserves.

Final Thoughts

The job search doesn’t have to be overwhelming. When you approach it with clarity, intention, and the right tools, you don’t just find a job—you find your job.

That’s why we created the APEX Job Board: to take the guesswork out of the search and give CRNAs and SRNAs a smarter, more focused way to find meaningful work.

Ready to take the next step? Start your search on the APEX Job Board.

Just published in the highly regarded journal Nature, researchers analyzing the brain tissues of deceased individuals reported finding a disturbing amount of microplastics widely distributed in the CNS. Extrapolating, they suggested there may be five bottle caps worth, like the ones on a disposable water bottle, that may accumulate in our brains over the lifespan.

Let’s start with a little positivity—when surrounded by so much that is grim, it’s nice to brighten our view and illuminate the good. Geophagia may be good for you. Yes, that’s right, eating a little dirt may be just what we need. But wait, as a bona fide healthcare provider, you cite the standard in the field: the Diagnostic and Statistical Manual for Mental Disorders (DSM-V). In this reference to all things that meddle with our minds, the DSM-V is the psychiatric Bible, and it describes geophagia (classified within the broader category of “pica”) as a type of eating disorder.

Now, we are not talking about going out into your backyard and adding scoops of dirt to your breakfast cereal or your evening’s macaroni and cheese, only to note that the body has a way of informing you of a need for something. Geophagia is universal, relatively harmless when practiced appropriately, and may protect humans and animals from certain bad things. Getting a little dirt in your food, or while you or your child gets a little dirt in the mouth during outdoor play, may have beneficial effects like enhancing your immune system, diversifying your gut microbiome, and even providing some helpful skin microbes. A more cautious approach might involve using safe products that are commercially sold. We should be careful not to stigmatize someone who suggests that geophagia is a salubrious dietary adjunct. It’s all about context; they may be right!

Table of Contents

Let’s look at a few areas where these microplastics may be coming from

Vaping

There’s a good chance you’ve never heard of the Globally Harmonized System of Classification and Labeling of Chemicals, mercifully shortened to GHS. Developed by the United Nations, it establishes and specifies what information should be included on labels of hazardous chemicals and the products that may contain them. The ubiquitous e-cigarette contains over 180 compounds that, when exposed to the high temperature created by the devices, transform into 153 compounds that are considered health hazards and over 200 chemical irritants, as reported in a recent JAMA. It is particularly concerning that long-term use or secondhand exposure to vapor containing these chemicals could lead to a new wave of chronic diseases. These health issues may not become evident until a decade or two later for those who use these products.

The air we breathe

Then there is the issue of the ambient air that all Earthlings breathe. The Environmental Protection Agency established 6 ambient air factors considered health threats: nitrogen dioxide, sulfur dioxide, lead, carbon monoxide, particulates, and ozone. Depending on where you live, the outside air can contain a remarkably complex soup of particulates, gases, vapors, and organic and inorganic compounds. These additives largely originate from the combustion of fossil fuels, industrial production of pollutants, and terrestrial fires.

Airborne particulates <100 nanometers (about the size of an average virus) are of particular concern as they can easily traverse our epithelial, endothelial, and neural barriers and penetrate our organs, including the brain. As we noted, their sources are varied, from tobacco smoke, cars, trucks, cooking, cleaning products, plastics of all kinds, fires, and natural and manmade disasters. The latter includes conflict-zone bombs, industrial accidents, and events like the 9/11 attack.

Urban, industrial, and mass transportation corridors may be saturated with ambient air festooned with toxic compounds. Polycyclic aromatic hydrocarbons (PAHs) are ubiquitous in our ambient environment and air, many of which are not routinely measured and have implications for global health. It is believed that PAHs are harmful to the developing young brain, are carcinogenic, and negatively affect endocrine function. Breathing polluted air is associated with a host of cognitive impairments and has a strong association with an increased risk of neurological disorders, including Alzheimer’s and Parkinson’s disease.

Based on what we know and the potential and real threats posed, air pollution is a major public health issue. Translational research is needed to inform and generate moderating strategies. We all face varying levels of risk, and compliance with legislation to reduce pollutants is urgently needed.

Plasticization of the human body?

We recently visited an exhibit at our science museum of once-living human bodies and organs that were donated and then plastinated to permit the public to visually explore the intricacies of what lies within each of us. This method deliberately uses compounds to permanently “fix” tissues in a real yet surreal state. This got us thinking about how our diet—and breathing—may be plasticizing ourselves from the inside.

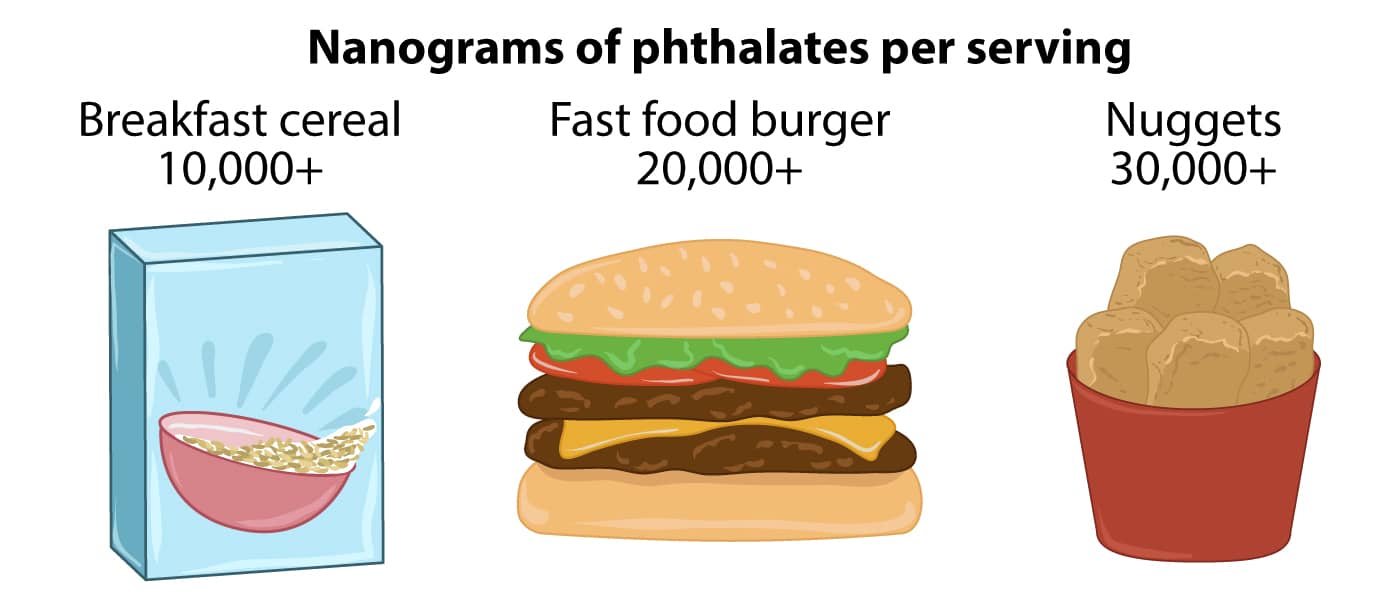

We know that plastics have been injected into every geographic niche on planet Earth—no soil, air, or ocean is plastic-free. Microplastics and nanoplastics—categorized based on size—are pervasive and Machiavellian in their design. They are in the fish in the sea, in the snow and rain falling from the sky, and ride the wind worldwide. Those of you who enjoy a hot cup of tea, steeping those single-use tea bags, release billions of microplastics and nanoplastics into what you are about to drink. Beer, canned soup, salt, fruits and vegetables, bottled water, and emissions from auto and truck tires while driving are all sources of microplastics. Unsurprisingly, there are microplastics in our tap water, well documented in several WHO reports. Plastics are throughout our bodies, not just in our cells and organs, but in our secretions: microplastics are found in breast milk and semen.

Considering the CRNA’s work environment, recent research finds an astounding concentration of microplastics in the ambient OR environment. Most of these come from the unwrapping of single-use, sterile products, surgical drapes, our OR attire, opening drug vials, and many of the myriad activities we engage in daily.

Despite not knowing the health consequences of being awash in an ambient sea of microplastics, as with many issues, we tend to “kick the can down the road” rather than proactively manage it. That said, it just seems prudent that both researchers and clinicians need to get to work on this. For example, shouldn’t we be devising novel methods of packaging the things we use and crafting ways to open them without expelling microplastics into our work environment?

Consider one effort: Verra, a nonprofit that is currently the world’s leading certifier of carbon credits extensively used in the global economy. Verra is now working with the industry to develop high-impact plastics intervention plans to certify them as “plastic neutral” and develop practical alternatives. Humans are complex problem solvers! We can do this!

What about what we eat and drink?

Consuming food and fluids is essential to maintaining life, but there are risks, some of which are potentially fatal. We are familiar with the ever-rising rate of obesity and its close association with certain diseases, but things in our diet carry other risks that we should consider. Many risks are linked to time and culture, one example being where the lack of water free of threatening microbes and contaminants is problematic worldwide and occasionally even in the U.S.

Microbial food contamination is most often related to Salmonella, Campylobacter, Escherichia coli, Listeria monocytogenes, Clostridium perfringens, hepatitis A, or norovirus infections. and though occasionally fatal, their incidence is likely underreported. Abdominal discomfort, diarrhea, vomiting, and fever may commonly occur but are not specifically attributed to a food supplier when a major outbreak occurs (recall Chipotle’s $25 million fine in 2020). The American Medical Association estimates that there are over 48 million foodborne illnesses in the U.S. annually.

Mercury in fish and seafood, pesticides on fruits and vegetables, colorants, flavorings, and preservatives are reported to have adverse consequences. Even the sweetener aspartame is on the radar. The WHO’s cancer research arm, the International Agency for Research on Cancer, labels aspartame as “possibly carcinogenic to humans,” giving it a strength of evidence rating of 2B—the third highest evidence rating out of four levels. And then we are warned that even barbecuing certain foods—steaks, chicken, hot dogs, hamburgers—produces carcinogenic dioxins and nitroso-compounds. Then, of course, there is food contamination with physical contaminants like glass, wood, metal, and insects, to mention just a few.

When recommendations on what to do get confusing

Our trust (or faith) in our government, medical organizations, or industry varies greatly. Medical sources tend to be the most trusted, followed by the government and industry. When different accounts emerge from the three, it can bewilder the consumer and is likely to fuel distrust in all three. A good example is alcohol consumption.

There’s no shortage of alcohol-related research over the years, and the science has evolved. Many believe that light or moderate drinking is healthy based on a 1997 study in the New England Journal of Medicine, whose authors concluded, “In middle-aged and elderly populations, moderate alcohol consumption slightly reduced overall mortality.” Later analysis found great flaws in the study’s conduct and interpretation. At around the same time, the “French Paradox” emerged, linking red wine to lower rates of cardiovascular conditions, primarily due to the polyphenol resveratrol found in wine. This, too, proved a flawed conclusion: resveratrol was found only in sub-clinical amounts in red wine, and none in white wine, and other factors in the French sample accounted for the effect.

The bottom line is that there is no protective effect of alcohol, and there is an elevated risk of cardiovascular conditions of all kinds, hepatic and colon cancers, and neurodegenerative disease with each progressive drink. The medical community remained concerned and skeptical from the start that alcohol is good for your health.

Where does it all leave us in 2025?

We all like to eat, drink, and breathe! Certainly, any ingested substance, by whatever route of administration it is delivered, is potentially harmful. We are reminded of the famous axiom of the Swiss chemist and physician Paracelsus, who, over 700 years ago, penned a foundational principle of toxicology: “All things are poison, and nothing is without poison; only the dose makes a thing not a poison.” We know it today as “the dose makes the poison.”

Be aware and exercise appropriate caution out there! While there are lots of potential toxins out there, live your life not with anxiety but with purposeful mindfulness. Maybe a little less microwaving in those plastic “steamer pouches” for starters?

As CRNAs ourselves, we understand the challenge of fitting CRNA continuing education credits into your busy schedule. When you’re ready, we’re here to help.

Do you feel well-prepared for the National Certification Examination (NCE)? Are you looking for an additional resource to help prepare you for the Self-Evaluation Examination (SEE)? While studying for these exams (or any exam for that matter) may invoke anxiety, adequate exam prep will help you build confidence and achieve success.

That’s where we want to help! APEX Anesthesia Review was founded by CRNAs. We have the tools you need to prepare for the NCE and embark on your professional career as a Certified Registered Nurse Anesthetist (CRNA).

The challenge behind CRNA boards

The CRNA boards are complex, meaning you shouldn’t rely on rote memorization to pass. Administered by the National Board of Certification & Recertification for Nurse Anesthetists (NBCRNA), the NCE assesses one’s capability to deliver safe patient care, evaluating one’s knowledge after years of education, clinical experiences, and extensive study.

Fear of failure is understandable; however, 89.3% of first-time NCE candidates passed in 2024. With the appropriate CRNA board prep, you can also be successful on your initial attempt!

APEX Anesthesia’s Boards Bootcamp for CRNA board prep

Our two-day CRNA board review course will help you develop the confidence you need to sit for this stressful exam. Join us at one of our regional events near you to gain a fresh perspective on high-yield NCE content.

During this in-person learning experience, you will:

- Learn from world-class instructors via Zoom

- Grasp high-yield concepts and encounter board-type questions

- Receive new practice questions and printed handouts

- Network with fellow SRNA peers

- Take a pre- and post-exam exclusively for Bootcamp students

Review lectures are impactful and integrate all four NCE content domains. Throughout the live event, you will receive expert advice on test-taking strategies and have the opportunity to ask questions, ensuring you walk away feeling knowledgeable and confident.

Hear what your peers have to say about it!

How to lay the groundwork before Bootcamp

Although not required, we recommend completing our online course at least once before the live event. The Boards Bootcamp is designed to supplement APEX’s online SRNA review course, helping students avoid the confusion caused by inconsistent NCE information between vendors.

With the APEX Student Review Course, you’ll learn efficiently and enhance your critical thinking skills. It features:

- Rapid and in-depth reviews in every lesson

- More than 3,000 board-type questions

- Thousands of flashcards and interactive elements

- Illustrations, tables, and videos to engage all learning styles

And we recommend that you employ smart study strategies throughout your journey.

Solidify your knowledge after bootcamp

After attending the bootcamp, you should reinforce your understanding with an NCE question bank. We provide an add-on SmartBank with 1,250+ board-style NCE/SEE practice questions exclusively for APEX Student Course users. This will expose you to item types you’ll see on exam day, further refining your test-taking skills.

The SmartBank surfaces content weaknesses and strengths through the performance dashboard, provides content references from the Student Review Course for quick review, and has an app for you to learn from your Apple or Android device.

Plus, you can gain 1 year of access when you add on today. Just activate the SmartBank when you’re ready to start testing!

Get the best value and the most benefits for CRNA prep—reserve your bootcamp spot today.

Most CRNAs prepare for job interviews by updating their resume, thinking through their clinical experience, and rehearsing how they’ll answer common questions. These are important, but they’re only half the equation.

The truth is, you’re interviewing them too.

Asking smart questions during your interview positions you as a professional who values alignment, not just a paycheck. It gives you a clearer picture of what the job will feel like if you choose to accept it. It also helps you spot hidden expectations, understand the team dynamics, and avoid surprises down the road. We’ve given you a lot of interview questions, so only ask the ones that are relevant to you (you don’t have to ask all of them).

We won’t cover compensation and benefits in this guide. For a deep dive into how to evaluate salary structures, contract terms, retirement plans, CME allowances, and other financial considerations, check out our companion article: Understanding CRNA Compensation and Benefits: It’s More Than Your Salary.

Table of Contents

- Clinical Practice and Autonomy

- Culture and Team Dynamics

- Leadership and Management

- Schedule and Lifestyle

- Don’t Ask These Questions Too Early

- Follow-Up Questions

Clinical Practice and Autonomy Questions

- What level of autonomy do CRNAs have in their daily practice? This gives you a direct sense of how independently you’ll be allowed to function.

- What clinical decisions are CRNAs expected to make independently without MD input? This reveals the true scope of your autonomy and how much critical thinking is expected or supported.

- Are there certain cases or procedures that CRNAs can’t do (i.e., are only done by the anesthesiologists)? This helps you determine whether you’ll be able to work at (or near) the top of your license or be restricted to a narrower scope.

- Who decides how cases are assigned (CRNA leadership, anesthesiologists, or schedulers)? How are case types distributed? Knowing how cases are distributed reveals whether the system is fair and transparent.

- Do CRNAs typically manage their own pre-op assessments, anesthetic plan, and PACU handoffs? This gives you insight into the workflow and how much clinical ownership you’ll have.

- Are CRNAs allowed and expected to place regional blocks and invasive lines? This indicates both the scope of your clinical practice and whether you’ll keep or build advanced skills.

- What role do CRNAs play in OB, trauma, or other high-acuity situations? The answer shows whether CRNAs are fully integrated into critical care scenarios or sidelined.

- In a care team model, how involved are anesthesiologists during routine cases? This helps you gauge whether autonomy is supported or undermined by micromanagement.

- What percentage of the time are anesthesiologists present to meet TEFRA requirements? This helps you assess whether the practice is truly compliant or cutting corners, which can affect both your autonomy and legal risk.

- How is CRNA competence assessed when it comes to complex or advanced cases? This reveals whether you’ll have the opportunity to grow into tougher assignments or be held back.

- Is there a process for CRNAs to pursue training in new techniques, such as advanced regional anesthesia? This shows whether the culture supports clinical development and staying current.

- What happens when a CRNA needs help during a case? Who responds and how quickly? How is this different during normal hours and call? The answer reveals team responsiveness, safety culture, and how supported you’ll feel clinically.

- How are CRNAs onboarded for specific case types they haven’t done recently or often? A thoughtful onboarding plan is a sign that clinical autonomy is built on preparation, not pressure.

- How does the group handle disagreements between CRNAs and anesthesiologists about anesthetic plans? This helps you assess whether autonomy is respected or if you’re expected to stay silent.

- Do you employ AAs? If so, how is their practice different from CRNA practice? Are you valued as a CRNA or are you easily interchangeable with an AA?

Culture and Team Dynamics

Culture and Team Dynamics

- What makes someone successful here beyond purely clinical skills? This helps you understand the “unwritten rules” that define cultural fit.

- How long does the average CRNA stay at this job? Long tenure usually signals a supportive work environment and strong team cohesion.

- Can I speak with one or two CRNAs currently on staff (not locums) who have been here at least a few years? Talking directly with peers gives you a clearer, unfiltered sense of the day-to-day culture. Ask them if they had to make the decision again, whether they would choose to work here and why.

- What’s the team dynamic like between CRNAs, anesthesiologists, and AAs (if present)? This reveals how collaborative or hierarchical the group truly is in practice.

- What’s the team dynamic like between CRNAs and the surgeons and OR staff? This reveals how collaborative and respectful the overall working environment is, which directly impacts your daily stress level and job satisfaction.

- What does the group do, if anything, to build camaraderie outside the OR? Social dynamics outside of work often reflect how connected and supported staff feel. Some CRNAs thrive on this, while others don’t want to think about work after they leave the OR.

- Are there opportunities for CRNAs to take on leadership, education, or mentorship roles? This tells you whether the group values professional growth or sees CRNAs as disposable labor.

- How are mistakes handled here when something doesn’t go as planned? This reveals whether the environment is punitive or focused on learning and accountability.

- What’s one thing current CRNAs would like to see improved about the team or workplace? You’ll learn what frustrations exist and how transparent the group is about challenges.

- How does the anesthesia department or hospital deal with bullying or disruptive behavior from surgeons, anesthesiologists, or other staff? This can uncover toxic personalities or cultures that leadership may or may not tolerate.

- How does the team support each other during busy or understaffed days? You’ll get a sense of whether the group pulls together or whether you’re on your own.

- What happens if someone is struggling clinically or personally? How is that handled? Support during difficult times is a strong indicator of a healthy team culture.

- Are CRNAs encouraged to mentor new hires or SRNAs? A mentoring culture often reflects a collaborative and generous team dynamic.

Leadership and Management

Leadership and Management

- What is the leadership structure in the anesthesia department? Are any CRNAs included in the leadership structure? This helps you understand how decisions are made and whether CRNA voices are represented at the leadership level.

- How politically active are the anesthesiologists and CRNAs? How does this impact their day-to-day working relationship?

This can reveal whether leadership dynamics are driven more by clinical collaboration or behind-the-scenes power structures that could lead to animosity. - How does leadership gather feedback from CRNAs, and what do they do with it? This shows whether leaders are actually listening or just going through the motions.

- What’s an example of a recent change that was made based on CRNA input? A real example gives you proof that leadership is responsive, not just reactive.

- How are performance issues or clinical concerns typically addressed? The response reveals whether leadership is fair and constructive or punitive and distant.

- How transparent is leadership when challenges come up, such as staffing shortages or budget issues? You want to know whether you’ll be kept informed or blindsided by sudden changes.

- Who runs the OR board, and how are case assignments prioritized? This reveals how much influence CRNAs have in daily operations and whether assignments are made fairly or influenced by internal politics.

- Where do CRNAs hang out when not in a case? Where do they eat? Where do they park? This is a softer way of understanding how CRNAs are valued in the organization.

- Are there professional perks such as free meals and free parking? This helps you understand how CRNAs are valued by the organization.